Net Present Value (NPV) is a financial metric used in innovation to estimate the potential profitability of an investment by comparing the present value of its expected cash inflows to the present value of its expected cash outflows.

In the context of product innovation, the NPV (Net Present Value) calculation is a financial analysis method used to assess the profitability and financial viability of a product or innovation over its lifecycle. NPV takes into account the time value of money by discounting future cash flows to their present value.

In general, product innovations with a positive NPV are considered favorable investment opportunities, as they are expected to generate a return on investment. When comparing multiple product innovation projects, decision-makers often prioritize those with higher NPV values, as they are expected to deliver greater financial benefits.

Step-by-Step Guide:

- Identify Cash Flows

- Inflows: Expected revenue from the investment.

- Outflows: Initial and ongoing costs.

- Choose Discount Rate

- Reflects the opportunity cost or company’s required return.

- Define Time Period

- Set the investment horizon (e.g., 5 or 10 years).

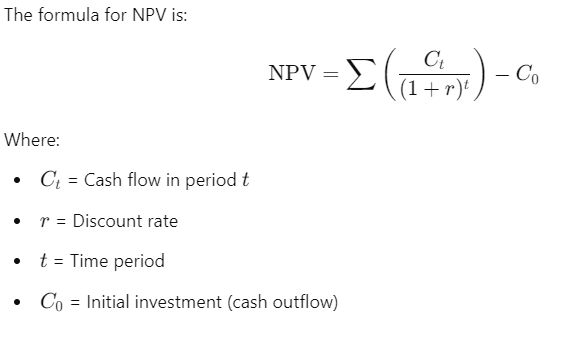

- NPV Formula

- Calculate Present Value

- Discount each future cash flow to present value.

- Sum All Values

- Add all discounted cash flows and subtract the initial investment.

- Interpret Results

- Positive NPV: Profitable.

- Negative NPV: Unprofitable.

- NPV = 0: Break-even.

This method helps assess whether an investment is worth pursuing.

Example:

General Electric (GE) is a notable example of a company that effectively uses Net Present Value (NPV) in its decision-making processes, particularly for capital budgeting and evaluating large-scale investment projects.

GE applies NPV calculations to assess whether major capital investments, such as new product lines, infrastructure, or acquisitions, will yield positive returns after accounting for initial costs and the time value of money. By incorporating NPV into its financial strategies, GE ensures that only projects that are expected to generate net positive returns (i.e., those with a positive NPV) are pursued, helping the company allocate resources efficiently and manage risk.

Other large corporations, such as Siemens and ExxonMobil, also use NPV as a critical part of their capital budgeting process to ensure that investments in new projects or expansions generate expected returns after adjusting for risk and cost of capital.

For more information on the topic, please see the source below:

Arnold, T. (2014). How Net Present Value Is Implemented. In: A Pragmatic Guide to Real Options. Palgrave Macmillan, New York. https://doi.org/10.1057/9781137391162_1

#NPV #NetPresentValue #FinancialModeling #InvestmentAnalysis #CashFlowProjection